DeFi’s success this season has been phenomenal. Many analysts have called this phenomenon a bubble that will unavoidably burst. So should investors direct their investments to the main tokens of decentralized Finance?

Using the opportunities of cryptocurrency market

2020 will go down in cryptocurrency history as the year of DeFi. It’s been a long time since we’ve seen a hype of this magnitude, probably best matched by the 2017 ICO hype.

Decentralized finance is based on the idea that blockchain technology can be used to recreate traditional financial instruments such as loans and insurance. From Maker to Compound and Aave, DeFi users who are considered to be liquidity providers, benefit from the high interest rates available to them under these protocols.

Let’s take a brief look at the main decentralized Finance platforms with their own tokens, which they use to manage protocols, and enjoy the greatest success.

- MKR

Without a doubt, Maker is one of the most popular DeFi protocols on the market. The decentralized credit platform supports Dai, another ERC20 token, but it is a stablecoin whose value is pegged to the US dollar based on a basket of other cryptocurrencies. Maker allows anyone to open a vault for fixing cryptocurrency security and generate Dai for this security. As a decentralized Protocol, it also allows liquidity providers to vote on management issues using the MKR token.

What the MKR token provides is that it is needed to pay stability fees when using CDP, such as using ETH to pay gas fees when using Ethereum. This burns MKR, reducing the overall supply and making the asset more scarce. Owning MKR gives you access to voting on management proposals, as well as the stability of the Dai stablecoin.

MKR token chart from the beginning of the year on the Maker platform.

Source: CoinMarketCap

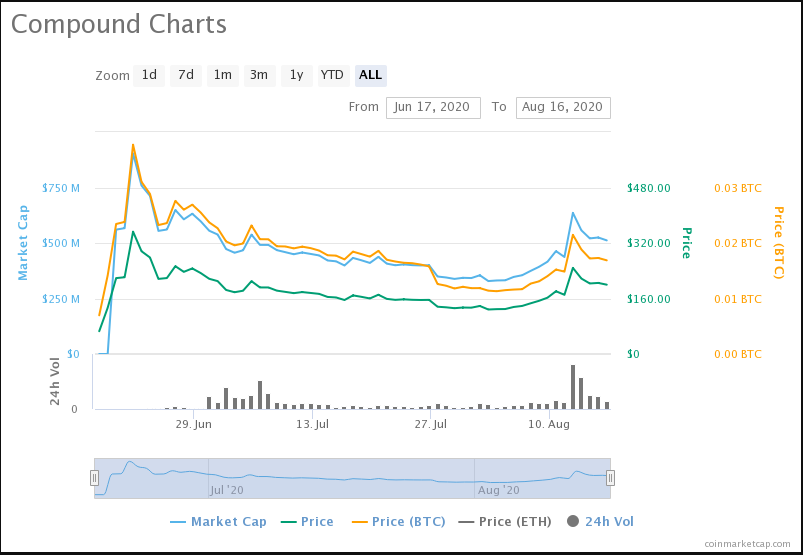

- COMP

Another management token issued by the algorithmic interest and money market fixing Protocol is Compound. The COMP token was released in June for the mining community. In other words, as a liquidity provider using various pools on Compound Finance, you earn COMP tokens to ensure the Protocol’s liquidity.

You can also vote for management proposals using the COMP token. As mentioned earlier, the idea of earning a COMP token, rather than buying it simply by providing liquidity, caused a frenzy in the industry. As such, the COMP rose to $ 372 per asset, an all-time high in the week before it started correcting, and fell to $ 126 in August.

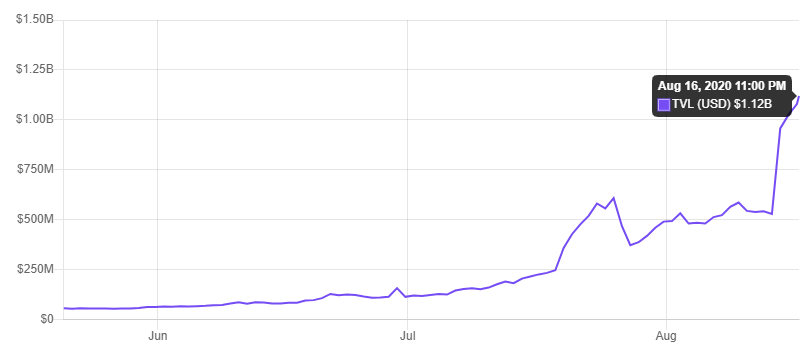

At the time of writing, the total blocked value (TVL) on the main DeFi platforms has reached $ 7 billion. And it doesn’t look like it’s slowing down.

COMP traffic schedule since its launch. Source: CoinMarketCap

- AAVE

Aave is also an open source Protocol, and is not associated with data storage, allowing DeFi users to create money markets. By introducing innovations such as flash loans, credit delegation, cold wallet voting, and others to the decentralized Finance space, Aave continues to demonstrate itself as a powerful money market Protocol of the future. A quick look at DeFi Pulse shows that TVL Aave is growing rapidly. TVL over the Protocol has passed the $ 1 billion milestone, which indicates a huge interest of users in the platform.

In addition, Aave is going to completely switch to AAVE, the control token of its Protocol. However, the price of LEND, its own token, rose a few months ago after a prolonged bearish state, and the growth has not stopped since.

Source: CoinMarketCap

Looking at all of the above charts, it becomes obvious that we are experiencing a major bullish growth in DeFi. However, while there are many other management tokens such as CRV, YFI, and so on, other ERC20 tokens are also actively deposited into DeFi protocols. BAT, ZRX, REN, ENJ, and MANA act as collateral for creditors in many of these protocols. Consequently, DeFi has opened up a new use case for these tokens in addition to their original and intended functions.

Metrics to consider when investing in DeFi tokens

Sound investment decisions are not like gambling. Risk itself is an investment decision based on available data. While many of these projects may seem like lucrative investment opportunities, you as an investor should not look at the surface, but deep inside. Important technical and fundamental indicators must be taken into account.

For fundamental analysis you need to check the command ecenomic and the business model behind the project. If you think back to Aave, a look at the team shows that the team is very experienced, continuing to generate revolutionary ideas. It is very important to keep an eye on the project and the LEND token, which will soon switch to the AAVE management token, from flash loans to loan delegation and a whole new set of offers. In short, the team should make a big difference before considering investing in any DeFi token.

Another important factor to consider is the price-to-earnings ratio of some of these tokens. The P / E ratio means that the market is willing to pay x dollars for every dollar produced by the company. This helps you find out if the DeFi token is overbought or sold. This is a form of technical analysis that may require some mathematical skills. In its simplest sense, it calculates how much of the network’s valuation is reflected in daily transactions or network usage.

But a simpler resource for tracking this metric is Token Terminal, which is still in beta testing. You can easily see the NVT ratio for the listed DeFi tokens. The higher the value, the more promising it looks.

The use of tokens

As we pointed out earlier, most DeFi tokens serve as an important useful tool within the DeFi-verse framework. Lenders can place them in liquidity pools to start unlocking interest, which increases over time. These tokens can be unlocked at any time without permission or punishment. This is one of the brand advantages of DeFi.

In addition, users of the DeFi Protocol tend to use a new practice called crop cultivation. This is the practice of constantly moving tokens in search of high-yield positions. And perhaps the most important function of these tokens is the managerial voting rights they grant to holders. Owners of MKR, COMP, YFI, and so on can vote for Protocol improvements because they contain their own Protocol tokens.

Related risks

The risks associated with investing in DeFi tokens are mainly based on smart contract errors. Since most protocols are built on similar stacks of smart contract technologies, failure of one of them may end up creating a risk for others.

And, as in ICO days, fraudulent DeFi tokens are created daily and added to non-authorized DEX such as Uniswap. DEX allows anyone to place tokens without any ID verification. Unsuspecting investors may fall victim to these schemes, which are nothing more than classic pump and dump schemes.

In addition, crop cultivation has been criticized for being an unsustainable model that will fail. This is due to its fast pace and high interest rates that validators are looking for. DeFi users in search of profit most of the time pool their funds, just to attract more profit in the form of tokens distributed over protocols when users provide liquidity. These tokens are distributed as management tokens that allow users to vote on suggestions for improvements.

High-yield validators are unlikely to put their management crypto assets on suggestions for improvement. Rather, they use them to make a profit at any sign of price increases. This is one of the reasons why crop cultivation has attracted huge criticism even from DeFi OG. Moreover, this is a practice that only very experienced arbitrators should participate in.

Summarize

DeFi could definitely be the word of the year in terms of the crypto space. For the first time, decentralized exchanges have surpassed centralized exchanges in popularity. Decentralized Finance has attracted an incredible number of new investors who want to invest their assets in liquidity pools to make a fortune.

However, investors should not forget that the cryptocurrency market is very volatile and follows certain rules that must be followed in order to survive in the world of DeFi:

- Exploring the space

When you decide to invest in the DeFi token market, do your own research on the project you are interested in. This is quite common advice, but it is very important.

- Follow the communities

Once you have decided on the platform and studied the documentation, find user communities in social networks. There are many forums and social networks, such as Reddit, Twitter, Telegram, and other DeFi communities. Each project can have its own topic on any cryptocurrency forum, such as BitcoinTalk. By tracking the success and failure of a particular project, you can easily decide when to invest or withdraw money.

Social networks and blogs can provide valuable information. Check if the project is available on sites such as DeFi Prime, DeFi Pulse, and DeFi Market Cap. This includes only authoritative protocols.

- Beware of the risks

Risk management is an integral part of everything related to crypto and decision making. In the world of DeFi, there is even a certain classification of risks that can catch up with an illiterate investor.

Since the DeFi market is decentralized, there is constant risk. Each project has its own requirements and laws to change the level of decentralization, so you should be extremely careful.